unfiled tax returns reddit

Reddits home for tax geeks and taxpayers. You can get a tax return rejected by the IRS for several reasons such as a misspelled name inaccurate information on a dependent or entering an incorrect date of birth.

Received A Confusing Tax Letter Here S What Experts Say You Should Do

There are two reasons primarily used for non-assertion.

. Posted by 3 years ago. Welcome to Reddit the front page of the internet. News discussion policy and law relating to any tax - US.

The IRS is experiencing significant and extended. I had unfilled taxes from 2009 to 2016. And International Federal State or local.

Now the Franchise Tax. You start by collecting all your W-2s 1099s and any other income documents you have. Log In Sign Up.

Ad The IRS contacting you can be stressful. He told me once. If you need wage and income information to help prepare a past due return.

If you have old unfiled tax returns it may be tempting to believe that the IRS or state tax agency has forgotten about you. With most late filed tax returns you can request that the IRS not assert applicable failure to file or pay penalties on balance-due returns. Part of the reason the IRS requires six years is manpower the IRS cannot administer and staff the enforcement of unfiled tax returns going back as far as 10 or 20.

Offer in compromise and unfiled returns. If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing the. We work with you and the IRS to settle issues.

Call the IRS or a tax professional can use a dedicated hotline to confirm that you only have to go back six years back for unfiled taxes. Need Help with Filing Unfiled Tax Returns. They were recently done by a tax pro I was referred to.

A single person making up to 12k in 2018 and 2019 with only a W2 does not need to file as they will have 0 taxable income. 10 years of unfiled taxes. For filing help call 1-800-829-1040 or 1-800-829-4059 for TTYTDD.

We just mailed all the returns. I havent filed since then either because it felt insurmountable and just gets worse with time. If you dont have some go to IRSgov set up an account request transcripts for incomewages.

Offer in compromise and. Total bill is about 13k. Start with a free consultation.

The Internal Revenue Service announced it will visit more taxpayers who havent filed tax returns for. Need help with Back Taxes. However you may still be on the hook 10 or 20 years.

Question about Mortgage with unfiled tax returns Taxes I am attempting to finalize a conventional 30 year fixed rate mortgage and was wondering if I would have an issue at. IRS increasing focus on taxpayers who have not filed tax return. Become a Redditor and join one of thousands of communities.

It was lower before the new tax law. Help Filing Your Past Due Return. You Wont Get Old Refunds.

I didnt file income tax either CA or federal one year probably 2009. Read This Now - Nick Nemeth.

Eastern State Penitentiary Eastern State Penitentiary Penitentiary Eastern

10 Years Of Unfiled Taxes R Tax

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Unfiled Tax Returns Tax Lawyer Serving Clients Nationwide We Solve Tax Problems

Irs Notice Cp2000 What Is It Massey Company Cpa Atlanta

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes

Here S What Happens If You Don T File Or Pay Your Taxes The Motley Fool

Forgot To File Taxes In 2013 And Irs Just Notified Me In 2020 R Tax

I Received This Letter Today From The Irs I Talked To The Tax Advocate Thursday R Irs

Irs Tries To Reassure Pandemic Panicked Taxpayers

Irs Tries To Reassure Pandemic Panicked Taxpayers

Unfiled Past Due Tax Returns Faqs Irs Mind

Can The State Take A Federal Refund Due To Owed Taxes From Last Year

Can I Go To Jail For Unfiled Tax Returns Tax Resolution

Immigration And Lying On Your Tax Return The Quickest Way To Deportation Verni Tax Law

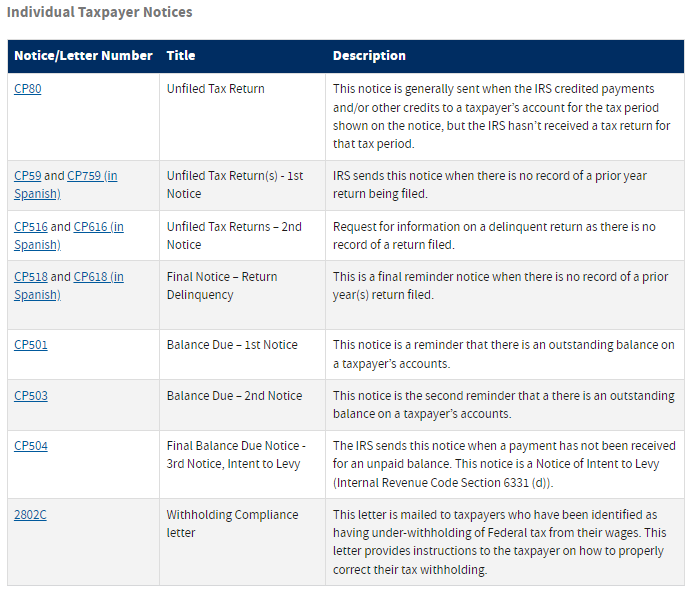

Irs To Suspend Mailing Additional Letters Afsg Consulting

Activity Where S My Refund Tax News Information

The Impact Of Unfiled Tax Returns On Your Security Clearance

Irs Notice Lt26 The Irs Still Hasn T Received Your Tax Return H R Block